Top 8 Tips for Budgeting as a Beginner

Mon Jun 03 2024

Managing your personal finances can seem daunting, but creating and sticking to a budget is a crucial step towards financial stability and achieving your goals. Whether you're a recent graduate, starting a new job, or simply looking to get your finances in order, these top 10 tips will help you kickstart your budgeting journey.

1. Determine Your Income

Understanding your income is the foundation of any budget. It's crucial to have a clear picture of how much money you have coming in each month. Start by listing all your sources of income, including your primary job, side hustles, investments, or any other revenue streams. If you're a freelancer or have variable income, calculate an average based on the past three to six months.

For example, if you have a full-time job that pays $3,000 per month, a side hustle that brings in an average of $500 per month, and $200 in investment income, your total monthly income would be $3,700. Knowing this number is essential for creating a realistic budget that aligns with your financial reality.

2. Track Your Expenses

Once you know your income, it's time to track your expenses. This step is critical because it helps you understand where your money is going and identifies areas where you might be overspending. Categorize your expenses into fixed (rent, utilities, loan payments) and variable (groceries, entertainment, transportation) costs.

To get an accurate picture of your spending habits, review your bank statements, credit card bills, and receipts for the past few months, and track your expenses regularly (i.e. through an app or spreadsheet).

For instance, if you find that you're spending $800 per month on dining out, you may want to consider cutting back in this area and allocating more money towards savings or debt repayment.

3. Set Financial Goals

Having clear financial goals is essential for staying motivated and on track with your budget. Identify your short-term goals (e.g., building a $1,000 emergency fund within the next six months) and long-term goals (e.g., saving $50,000 for a down payment on a house within the next five years).

Setting specific, measurable goals will help you prioritize your spending and make informed decisions about where to allocate your money. For example, if your goal is to pay off $5,000 in credit card debt within a year, you'll need to allocate approximately $417 per month towards debt repayment.

4. Prioritize Needs vs. Wants

Distinguishing between needs and wants is crucial for effective budgeting. Needs are essentials like housing, food, healthcare, and transportation, while wants are discretionary expenses like dining out, entertainment, or luxury purchases.

When creating your budget, allocate funds for your needs first, and then allocate a reasonable amount for your wants. For instance, if your monthly income is $3,000, you might allocate $1,500 for rent, $400 for groceries, and $200 for transportation (needs), leaving you with $900 for discretionary spending and savings (wants).

5. Use the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting method that provides a framework for allocating your income. According to this rule, you should allocate:

💵

50% - Needs💵

30% - Wants💵

20 % - Savings and Debt RepaymentWhile this rule can serve as a helpful starting point, feel free to adjust the percentages based on your specific circumstances. For example, if you have high-interest debt, you may want to allocate more than 20% towards debt repayment to pay it off faster.

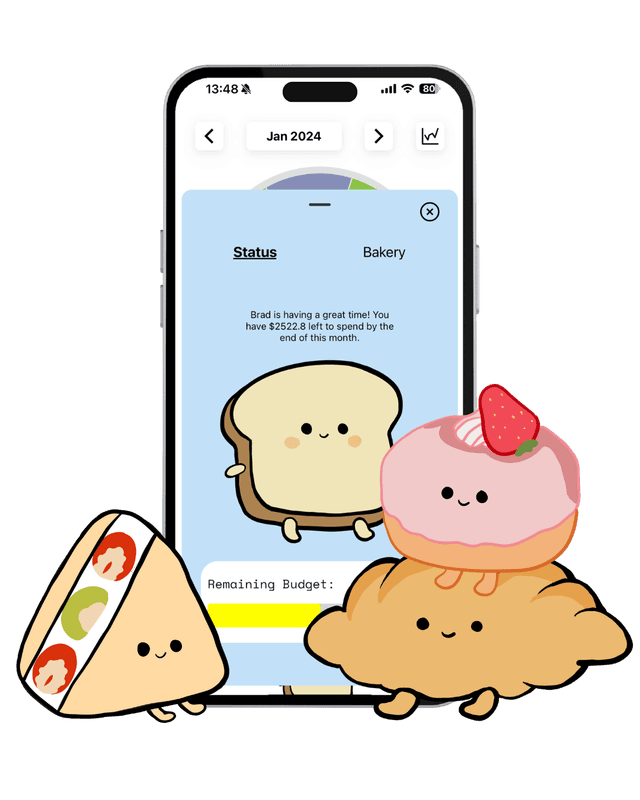

6. Use Budgeting Tools

Budgeting tools and apps can make the process of tracking your income and expenses much easier. Apps like Bread, YNAB (You Need A Budget), and Copilot allow you to securely link your bank accounts, categorize your transactions, and set up budgets for different spending categories.

For example, if you set a budget of $300 for groceries in Bread Budgeting, the app will track your grocery spending throughout the month and alert you if you're close to exceeding your budget. These tools can provide valuable insights into your spending habits and help you identify areas where you can cut back.

7. Review and Adjust Regularly

Budgeting is an ongoing process that requires regular review and adjustment. Set aside time each week or month to review your income, expenses, and progress towards your financial goals.

If you find that you're consistently overspending in a particular category, consider adjusting your budget or finding ways to cut back in that area.

For example, if you initially allocated $150 for transportation but find that you're spending closer to $200 each month, you may need to adjust your budget or find ways to reduce your transportation costs (e.g., carpooling, using public transit, biking).

8. Be Patient and Consistent

Developing good budgeting habits takes time and consistency. Don't get discouraged if you slip up or overspend in a particular category. Learn from your mistakes, make adjustments, and keep working towards your financial goals. Consistency is key to successful budgeting. Apps like Bread allow you to set up notifications to remind you to track your expenses on a daily basis.

Budgeting may seem overwhelming at first, but by following these tips, you'll be well on your way to taking control of your finances and achieving your financial goals. Remember, budgeting is a journey, and it's okay to start small and gradually improve over time. With patience and discipline, you'll develop a budgeting system that works for you and your lifestyle.

---

In conclusion, mastering the art of budgeting is a crucial step towards achieving financial stability and reaching your goals. By implementing these 10 tips and staying committed to the process, you can take control of your finances, reduce stress, and achieve the financial freedom you deserve. Remember, budgeting is an ongoing journey that requires effort and dedication, but the rewards are well worth it. Start putting these tips into practice today, and watch as your financial situation improves over time. Your future self will thank you for the investment you make now.